Bank Failures

The US is experiencing domino banking failures. First there was the Silicon Valley Bank in February, then Signature Bank in March, then First Republic in May, and now PacWest is teetering. The US and EU banks are already dealing with bankruptcies and insolvency and are flirting with the outcome if these trends do not change. One outcome is a US Digital Currency and another is the US becoming part of the BRICS consortium. The Zetas suggest that the Rothchild banks should cancel all debts already paid off by interest and cancel the National Debt which was an illegal debt from the start.

ZetaTalk Prediction 11/30/2019: We have long predicted banking failures going into the Pole Shift, due to a worldwide economic collapse from crop failures, earthquake damage to the infrastructure, insurance company bankruptcy, and consequent job loss with loss of income to the individual and to the GDP. Governments will at first respond by printing or producing more money, though fragile countries will be forced to declare bankruptcy. Weak banks will be closed to be absorbed by larger and stronger banks, but this process does have an end point.

Central Banks are at present pumping more liquidity into their banks. Banks make their money when the loans they make are paid back with interest, but if loan failures occur, or the public fails to make new loans, then the banks do not have their anticipated income. Fat cat bankers and their stockholders are distressed. By pumping liquidity, the banks have more funds to loan and more funds for their expenses. This process can continue until the Central Bank can no longer risk running the currency at its base into insolvency.

We have predicted that the world will go into the barter system as the Pole Shift approaches. As foreclosures increase, banks will find they do not have the resources to monitor these properties, and they will be repossessed by their former owners or by strangers. Stocks and bonds will lose their value, with the Stock Markets being considered a joke. Tricks like a negative interest rate are already considered a joke. Why would someone buy a bond when it will cost them money? A currency, such as the Yuan or US dollar, or Euro will continue to be used as a medium of exchange on the street and in shops, however.

- Another Bank Collapse? As Pacific Western Bank Stocks Fall, Fears of Crisis Resurface

May 4, 2023

https://www.usatoday.com/story/money/2023/05/04/bank-collapses - San Francisco-based PacWest Bancorp’s shares plunged more than 39% and were halted for volatility multiple times after investors learned the regional bank was considering a sale. While the bank says it has not experienced a high number of customer withdrawals, the news still stoked fears of a potential surge in withdrawals among regional banks.

- First Republic Bank Seized, Sold to JPMorgan Chase

May 1, 2023

https://www.usatoday.com/story/money/2023/05/01/first-republic-bank - Regulators seized troubled First Republic Bank and sold all of its deposits and most of its assets to JPMorgan Chase Bank in a bid to head off further banking turmoil in the U.S. San Francisco-based First Republic is the third midsize bank to fail in two months. First Republic has struggled since the March collapses of Silicon Valley Bank and Signature Bank and investors and depositors had grown increasingly worried it might not survive because of its high amount of uninsured deposits and exposure to low interest rate loans.

- New York Community Bank to Buy Failed Signature Bank

March 19, 2023

https://apnews.com/article/signature-fdic-failure-new-york - New York Community Bank has agreed to buy a significant chunk of the failed Signature Bank in a $2.7 billion deal, the Federal Deposit Insurance Corp. The 40 branches of Signature Bank will become Flagstar Bank.

ZetaTalk Suggestions 2/28/2023: Where the Barter system is a frank exchange of items that are real and palpable, the issue of paying interest on a loan has proven to be fraught with opportunity for debt slavery and exorbitant interest. Many loans are paid off due to this exorbitant interest, yet are on the books and subject to legal action by the banks. We have predicted widespread banking and insurance company failure, with a leap to the Barter system as a result. Meanwhile, various Debt Relief schemes have been proffered to retain control of assets by the banks.

Debt Relief was proffered as a means of allowing the wealthy to buy homes and farms in exchange for mortgage relief. This is now called the Great Reset, and pushed by the WEF. Since the western banks are merely printing money from air, these Debt Relief or Great Reset schemes should be seen as the slavery traps they are. Major crimes in the past - such as stealing the Gold from Fort Knox - have been quietly countered and corrected by the Junta as a result of Gitmo prosecutions. Illegal assets were confiscated.

If the Federal Reserve is founded on an illegal contract with the Rothschilds, and their banks have been gouging for centuries with exorbitant interest rates, how to correct this? The Federal Reserve contract allows the bankers to print US dollars at will, then loan them back to the USA while charging interest. This is then imposed on the US citizens as a National Debt they are required to pay to the Fed. This debt instead should simply be dissolved, as should many public debts where interest has already repaid the principle.

Many western banks are already bankrupt and with the damage caused by the approach of Nibiru on the increase, a collapse of the banking system is rapidly approaching. This is inevitable in any case when the Pole Shift arrives in a few short years, with ownership of farms in the hands of those who have been working them and ownership of cars and homes likewise in the possession of those who currently possess them, with various Mad-Max scenarios playing out among survivor groups. Meanwhile various alternative banking schemes are floated out for discussion.

NESARA was one such scheme which never became law within the US, but which lingers on like a fantasy forever out of reach. This has lately been replaced by the Quantum Financial System, which claims that with sufficient oversight bank fraud and crypto theft would not occur. Of course both schemes assume that mankind will stop being nefarious and greedy, which does not happen on 3D worlds. Allowing BRICS rules to replace western banks, forcing the Rothschild banks to forgive all debts that have already been paid by interest, and dissolving the National Debt would be a start.

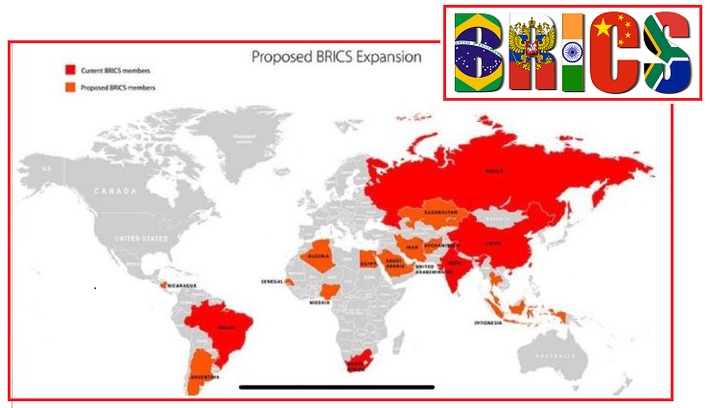

Meanwhile the BRICS Consortium is on the ascendancy. And BRICS has been talking about starting their own currency to challenge the right of the US Dollar being considered the ‘reserve currency’ around the world. But will the US and EU issue a new Digital Currency to replace their printed fiat dollars? Meanwhile the US and EU worry about how to calm their worried citizens while they try to hide the increasing bankruptcy of their banking networks.

- Indonesia Follows Suit in BRICS’s Dedollarization Move

April 24, 2023

https://www.businesstoday.com.my/2023/04/24/indonesia-follows-suit - The BRICS economic bloc – comprising Brazil, Russia, India, China, and South Africa – claims to be working on establishing a joint payment network to cut reliance on the Western financial system, and on the dollar in particular. The member countries have been increasing the use of local currencies in mutual trade and also working on establishing a new reserve currency. Last month, Brazil and China signed an agreement to trade in their own currencies, thus abandoning the greenback as an intermediary.

- Russia Talks up Prospects of BRICS Countries Developing New Currency

March 31, 2023

https://cointelegraph.com/news/russia-talks-up-prospects-of-brics - A top Russian official has reportedly claimed that the countries of the BRICS alliance — Brazil, Russia, India, China and South Africa — are working on creating their own currency. BRICS is an acronym for five leading emerging economies: Brazil, Russia, India, China and South Africa.

- 5 Oil Producing Nations ask to Join BRICS Alliance

May 2, 2023

https://oilprice.com/Energy/Energy-General/5-Oil-Producing-Nations - Saudi Arabia, the UAE, Algeria, Egypt, Bahrain, and Iran have formally asked to join the BRICS group of nations. BRICS is expected to soon surpass the US-led G7 states in economic growth expectations. In total, 19 nations have expressed interest in joining the emerging-markets bloc of Brazil, Russia, India, China, and South Africa.

ZetaTalk Outlook 4/30/2023: To hide the bankruptcy, Digital currency and IDs will be issued while everyone pretends that the funds have valid backing. NATO has become a hollow puffery, unable to win in the Ukraine which will quietly go to Russia. India has a large, starving population but rioting is held in check by the prevailing religion - the fatalistic Hindus. China also has a large starving population, restrained only by their Communist consensus practices. They repress their media to control their restive population.

With the death of General Milley, who will be officially replaced as head of the Joint Chiefs this upcoming Fall, there has been more open discussion within the US Military. By following China’s example regarding repression of the media, the citizens of the US can expect less controversy in the news, and more stability in politics such that an existing leader will be allowed in place even if incompetent or a Double. The US is already under Martial Law but will now be more open about it. The exploding crime rate will be controlled by brutal measures, with prison farms emerging.

- Next Phase of the Banking Crisis

May 4, 2023

https://www.theepochtimes.com/the-next-phase-of-the-banking-crisis - Notably, three of the four largest U.S. bank failures of all time—First Republic, Silicon Valley Bank, and Signature Bank—have occurred within the last 60 days. Over $72 billion held by non-U.S. holders invested in money market funds investing in U.S. bank securities were withdrawn in March. What we know is that the regional banks have been forced to tap the Federal Home Loan Banks for $1 trillion of liquidity (as at the end of March) as well as an additional $325 billion from the Federal Reserve’s emergency funding facilities. We have entered the next phase of the banking crisis. We can assume that deposit flight has resumed, and that some banks are scrambling to address liquidity issues. The U.S. government’s emergency facilities will help over the short run but are unlikely to provide a long-term solution. The banking regulators, specifically the Federal Reserve, the FDIC, and the U.S. Treasury, are running out of tools to address a widening crisis.

- Benjamin Fulford — May 1st 2023: Rats Abandon Biden Ship as US Financial Implosion Accelerates

May 3, 2023

https://stillnessinthestorm.com/2023/05/full-update-benjamin-fulford - Asia’s richest banker and chief executive of Kotak Mahindra Bank Uday Kotak says the US dollar is the “biggest financial terrorist in the world” later adding “What I meant was that a reserve currency has disproportionate power,” Over 18 countries are now trading directly with India in Rupees. Now Argentina and Indonesia are joining this move away from the Chinese/US dollar.

- more https://poleshift.ning.com/profiles/blogs/zetatalk-newsletter-as-of-may-21-2023

O.N.E. News - From the spiritworld